Home Equity Line of Credit

A home equity line of credit (aka HELOC) is secured by your home and can provide you a revolving credit line much like a credit card but typically has a better interest rate. The main difference is that you are borrowing on the built in equity in your home. This means you may borrow against your home at any time, and you can borrow a little and as much up to a specific limit. Generally there is a period of time you may draw money out from your HELOC and then there will likely be a repayment period.

Home equity lines are often used for home improvements which could increase the value of home, payoff high interest credit card debt or make major purchases.

Getting to know the basics

- Qualifying: To qualify you must have available equity in your home. The amount you owe on your home must be less than the appraised value. Typically the maximum amount we may lend is up to 80% of appraised value minus your mortgage loan balance.

West Virginia Federal Credit Union also reviews other factors such as monthly income, credit score, employment history and monthly debts, all of which enter into the credit approval decision.

- The index: The Wall Street Journal Prime Rate.

- The margin: The margin is the amount added or subtracted from the index (Wall Street Journal Prime Rate) which determines your rate for the home equity line of credit.

- The limit: The credit limit is determined by West Virginia Federal Credit Union.

For example purposes let’s assume the lender allows a maximum loan amount of 80% of your home’s appraisal value and your home appraises at $250,000, if you owe $150,000.00 on your current mortgage balance you would qualify for a credit line up to $50,000. (250,000 X 80%=200,000-$150,000=$50,000.00).

- The draw period: This is the period during which you can access your HELOC line. The draw period can vary from 5 to 10 years. Checks are provided for easy accessibility, as well as our online banking transfer option. Once you start accessing your HELOC you will be provided a monthly statement indicating the required minimum monthly payment. It is highly recommended to pay more than the minimum payment amount to decrease the balance and increase the amount of availability.

- Interest: You will be charged interest on any money borrowed against the HELOC. The home equity line of credit features a variable rate and is subject to change on a quarterly basis. We do have the discretionary right to modify your line limit at any time. Members will be notified of such changes to their credit limit.

We'll help make this process easy for you - stop by one of our convenient locations and speak with a Mortgage Loan Specialist to learn more.

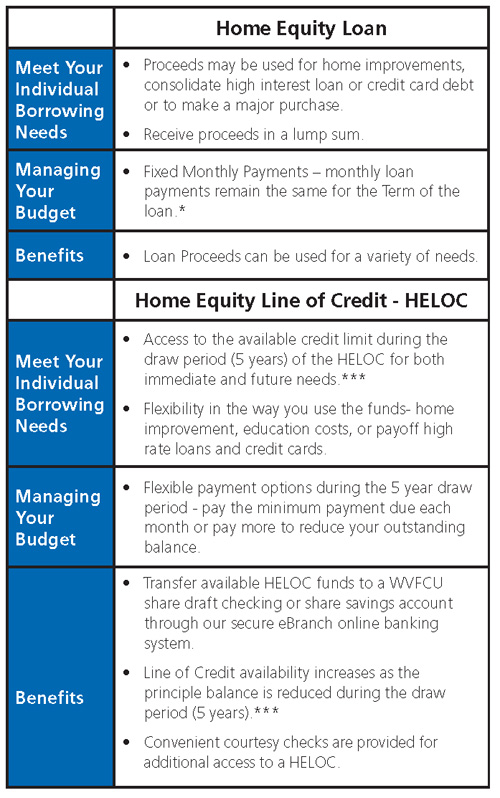

Which Option is Right for You?

The chart below helps you compare the benefits of both the Home Equity Loan and the Home Equity Line of Credit. Need further assistance call your local West Virginia Federal Credit Union at 304-744-MYCU (6928) and ask to speak to a Mortgage Loan Specialist; they can help you to determine the best option for your financial situation. We will be glad to take an application when you are ready.

*1st Lien Home Equity Loans are required to escrow taxes and insurance which will increase the monthly payment.

**Consult a Tax Professional about the tax deductability of interest.

***Home Equity Lines of Credit have a 5 year available draw period with an option to extend the draw period for an additional 5 years. There is a 10 year amortization for repayment after the draw period expires. Minimum monthly payment during the draw period is $150.00. Maximum term including 5 year draw period extension is 240 months. The index: The Wall Street Journal Prime Rate. The margin: The margin is the amount added or subtracted from the index (Wall Street Journal Prime Rate) which determines your rate for the home equity line of credit.

(Your actual rate, payment, and costs could be higher. Get an official estimate before choosing a loan/line product).

Go to main navigation