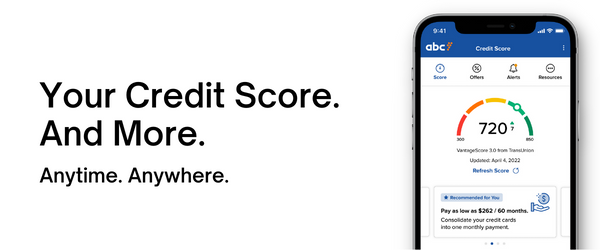

Credit Score powered by SavvyMoney is available to our customers through online and mobile banking. It is a free service to help our customers understand their credit score by giving them access to their full credit report.

Credit Score powered by SavvyMoney is available to our customers through online and mobile banking. It is a free service to help our customers understand their credit score by giving them access to their full credit report.

Option 1: Desktop – Login to online banking. Enroll into Credit Score by selecting the Credit Score widget located on the right-hand side of landing page and agree to the terms of agreement.

Option 2: Login to mobile banking and select the hamburger menu, located in the top left corner. Click to enroll and agree to the terms of agreement.

What is a Credit Score?

A credit score is a three-digit number calculated to indicate your credit worthiness. The higher the score, the more credit worthy you are to a lender. Credit score is calculated from information in your credit report and takes into account whether you have been making on-time payments, your revolving debt use, length of your payment history, and other such factors. It is important to know that your score does not take your age, income, employment, marital status, or your bank account balances into account.

You can learn more about credit scores and scoring models from the Consumer Financial Consumer Financial Protection Bureau website: https://www.consumerfinance.gov/ask-cfpb/what-is-a-credit-score-en-315/

What is VantageScore®?

VantageScore® was founded by the 3 leading credit reporting agencies – Experian, Equifax and TransUnion. This credit score model was developed by a representative team of statisticians, analysts, and credit data experts from each of the credit reporting companies, and is used by hundreds of institutions, including credit unions, banks, credit card issuers and mortgage lenders.

The VantageScore® 3.0, the score that is shown in SavvyMoney, is a newer and more popular version of VantageScore®. It is calculated on a scale of 300-850, with 300 being the lowest and 850 the highest score.

What does a good credit score mean to me?

A good score may mean you have easier access to more credit, and at lower interest rates. The consumer benefits of a good credit score go beyond the obvious. For example, underwriting processes that use credit scores allow consumers to obtain credit much more quickly than in the past.

What factors influence my credit score?

There are five major categories that make up a credit score:

40% Payment History

Essentially what lenders want to know is whether or not you’re good about paying your loans on time.

23% Credit Usage

Credit usage, also known as credit utilization, is the ratio between the total balance you owe and your total credit limit on your revolving accounts. It is best to keep your credit usage below 30%.

21% Credit Age

The age of your oldest account, the age of your newest account, the average age of your accounts and whether you’ve used an account recently are all factors related to the length of your credit history. In general, the longer your credit history the better.

11% Mix of Credit

Your score also takes into consideration how many total accounts you have and what types of credit you have. Your score will likely be higher if you have experience with different types of credit, like mortgages and installment student loans and revolving accounts like credit cards.

5% Recent Credit

Opening multiple credit accounts in a short period of time could represent a greater risk for lenders - those who see that you have multiple recent inquiries may worry that you are applying to so many places because you are unable to qualify for credit - or because you need money in a pinch.

Do race, age and other, non-credit related factors affect my VantageScore® credit score?

One of the most important misperceptions about credit scores is what information the VantageScore® model, or any credit scoring model for that matter, is NOT used. The VantageScore® model does not consider: race, color, religion, nationality, sex, marital status, age, salary, occupation, title, employer, employment history, where you live or where you shop.

What is a Credit Report?

Credit reports, also known as credit files, are composed of the credit-related data a credit reporting company has gathered about consumers from different sources. Credit reports include records of mortgage payments, credit card balances, credit card payments, auto loan payments and credit inquiries. It may also include accounts that have gone into collections, public records, and other information from government sources.

Credit reports include the following about your debt accounts:

Credit reports may also include:

Under Federal law, you are entitled to receive one free copy of your credit report from each credit reporting agency every 12 months. You can obtain a free copy of your credit reports at https://www.annualcreditreport.com or by calling 1-877-322-8228. For more information visit https://www.consumerfinance.gov/ask-cfpb/what-is-a-credit-report-en-309/.

How can I see what is in my Credit Report?

Not sure about what’s in your credit report? Click over to “Credit Report” to review all your accounts, payments, and more. You can also receive a free Credit Report from each of the credit reporting companies – Equifax, Experian and TransUnion once a year.

How do I correct my Credit Report if I think there is an error?

The three national credit reporting agencies receive and manage literally billions of pieces of credit use data each year, reported from some 13,000 different sources.

Given this incredible volume of data provided by lenders to the agencies, there are times when the information reported about your credit activities may be inaccurate.

If you find information that you believe is not correct on your credit report, contact the company that issued the account or the credit reporting company that issued the report. You can dispute any inaccuracies found on your TransUnion credit report by navigating to the bottom of the SavvyMoney Credit Report and clicking “dispute”.

For more information visit: http://www.consumerfinance.gov/askcfpb/313/what-should-i-look-for-in-my-credit-report-whatare-a-few-of-the-common-credit-report-errors.html

Why don’t my free credit reports include credit scores?

Your credit report and your credit score are not the same thing. Your credit report is all the information that a credit reporting agency has gathered about you. Credit reporting agencies calculate your credit score by plugging the information in your credit report into their proprietary credit score formula.

Federal law gives you the right to ask for a copy of your credit report from each nationwide credit reporting company every year for free. However, the law does not require the credit reporting companies to give your credit score for free.

For more information visit https://www.consumerfinance.gov/ask-cfpb/i-got-my-free-credit-reports-but-they-do-notinclude-my-credit-scores-can-i-get-my-credit-score-for-free-too-en-6/.

What is a Credit Freeze?

A credit freeze, also known as a security freeze, is a free way to restrict access to your credit report. Adding a freeze means you or anyone else cannot open a new credit account with the freeze in place. You can, however, temporarily remove this freeze at any time if you want to apply for new credit.

It is important to note that a credit freeze does not affect your credit score. And while the freeze is in place, you will still be able to apply for a job, rent an apartment, purchase insurance, and receive pre-screened offers.

How to place a credit freeze?

To place a credit freeze on your credit profile, you must contact each of the three major credit bureaus:

How to unfreeze your credit profile?

You must contact the three major credit bureaus to unfreeze your credit profile. Each bureau has a different process, but each will initially provide you with a PIN to unfreeze your profile.

Do only banks and lenders use credit scores?

Any institution that lends money – credit unions, banks, credit card companies, financing companies, and mortgage lenders, just to name a few – can use a credit score to help them assess whether you meet their lending criteria. These institutions are likely to use your credit score along with other information unrelated to your credit score that they have obtained directly from you, such as whether you’re working, your work history, your income, and your planned down payment. In general, borrowers with higher scores can get more credit, and at more competitive rates.

Lenders aren’t the only ones who may use your credit score. Insurance carriers can use credit scores to help predict losses, and to accurately price homeowners and automobile insurance policies.

Is credit score the only thing used by lenders for loan approval?

No, a credit score is just one part of a number of factors that lenders examine in their lending criteria. Among the criteria, beyond credit scores that a lender may consider are:

How do I improve my Credit Score?

There are several ways to improve your credit score. But it’s much more important to focus on improving what’s in your credit report rather than obsessing over your credit score. Here is some general advice:

If I leave a balance on a credit card each month, will I build a credit score faster than paying the card in full each month?

You will not build a solid credit score any faster by carrying a balance than you would if you paid your credit card balance in full each month.

The speed at which you build a credit score is largely based on the age of a credit card account, not whether or not you carry a balance. A credit card opened 12 months ago is a one-year-old credit card, regardless of your payoff or balance rollover practices. Additionally, carrying a balance on a credit card each month means you’ll incur interest charges.

The best way to build a solid credit score is to manage all of your accounts properly. Best practices include paying all of your credit obligations on time every month, applying for credit only when needed, and keeping balances on credit cards as low as you possibly can, if you cannot pay them in full each month.

Are charge cards treated the same as credit cards by credit scoring models?

The credit obligation associated with a charge card is similar to, but not the same as, a credit card obligation. As such, there are subtle differences in how they’re considered by credit scores.

A charge card is different than a credit card in that the balance is due in full each month, while credit card balances can be carried, or "revolved," month to month. Charge cards do not have published credit limits, where credit cards do.

Charge card accounts factor into credit scores, but they are not used by the VantageScore® credit scoring model for calculating various "balance to credit limit" measurements, because of the lack of a credit limit.

If I close my credit card accounts, can I improve my credit score?

Closing credit cards does nothing to improve your credit scores and, in fact, can backfire and leave you with lower scores.

When you close a credit card account, you lose the value of that card’s credit limit in the credit usage calculation. The credit limit is an important component when determining a consumer’s balance to credit limit or the “credit usage” ratio. This ratio rewards consumers who have low credit card balances relative to their credit limits.

If you close credit cards, especially those with large credit limits, you will likely cause your credit usage ratio to go up (if you carry balances). This can cause your score to go down, and down considerably in some extreme instances.

Additionally, if you close credit card accounts the credit bureaus will eventually remove them from your credit reports. Even though it can take years for an account to be removed from your credit reports, once it is gone you will get no benefit from your responsible management of that account.

Is medical debt a factor in my credit score?

Medical bills are usually not reported to the credit bureaus unless they have been unpaid for a long time and gone to collections. Collections accounts stay on the report for as long as 7 years even after you’ve paid them off. These accounts typically have an adverse impact on scores, though some scoring models do not include medical collections, especially those with small balances of less than $100. VantageScore® 3.0 does not take paid collections accounts into account in its model.

Source: https://www.vantagescore.com/newsletter/your-score-vs-medical-debt/

Will my credit score be higher the more loans I have?

It’s not the amount of loans that generates a good score – it’s how current a borrower keeps them and many other factors such as credit utilization, and the age of loan accounts. In other words, your score can be impacted positively by taking out only a certain number of sensible loans, and keeping them in good standing without missing payments.

Does shopping for a loan hurt my VantageScore® credit score?

Consumers are encouraged to shop for the best loan rates and conditions. Accordingly, the VantageScore® model does not penalize multiple inquiries made within a short period of time.

When several inquiries are made within a shortened timeframe, it is assumed that the consumer is shopping around for a rate and not opening multiple lines of credit.

The VantageScore® model uses a 14-day rolling window in which all credit inquiries are de-duplicated. All inquiries within that window are considered one inquiry regardless of the type of account. So regardless of whether the credit inquiry is made in response to a mortgage, auto or bank credit card application, it will be counted only once during that 14-day window.

I’ve always heard that the fewer credit cards I have, the higher my score. Is this true?

Credit reports are a reflection of an individual’s credit activity. Accordingly, there are potentially countless scenarios where the number of credit cards owned may impact your credit score. Prudent handling of your personal finances is the best way to manage debts. Therefore, it is generally a good idea to have a limited number of credit cards for long periods of time that have low balances and are kept in good standing.

If I have a credit balance on my cards, will my VantageScore® credit score improve?

If you have a credit balance, it means you don’t owe anything to your credit card lenders and they actually owe you, which is good from a personal financial management standpoint. Credit balance does not positively or negatively impact credit score.

As soon as I pay off my credit card debt, will my credit score get better?

The amount of debt you have in relation to the amount of credit you have available is a significant contributor to your credit score; however, it is only one of several factors. While your credit card and other loan balances may be low as a result of a recent payment, due to the lenders’ reporting cycles, it may take some time for the payments to be reflected in your credit score. Moreover, available credit and balances are only one of a number of other factors that are considered by credit score models. Improving your credit score can be achieved over time by regularly practicing these sound financial management techniques:

If I leave a balance on my credit card will it help me build credit more quickly than paying it in full each month?

The balance of an account has no influence over the speed at which you will build or re-build your credit reports or credit scores. A credit card with a $5,000 balance ages just as quickly as a credit card with a $0 balance. Further, even if you pay your balance in full each month there’s no guarantee that the account will show up on your credit reports with a $0 balance. Credit card issuers report your statement balance to the credit reporting agencies. That means even if you pay your balance in full any subsequent use of the card is going to result in a statement balance greater than $0.

One of the most effective ways to build or rebuild your credit is by responsibly managing the accounts that you currently have, or open in the future. Maintaining low balances on credit cards and never missing a payment will lead to better credit scores. However, that certainly doesn’t mean you have to live a debt free life in order to have solid credit. In fact, credit scoring models reward you for a track record of positive credit experience.

When I close a credit card account, will my credit scores always go down?

While it is possible for your credit scores to go down as a result of closing a credit card account, it’s not definite. The reason your scores could go down would be due to the loss of the credit limit of the newly closed card in your debt-tocredit limit ratio measurements. If you are carrying debt on other credit cards then your debt-to-limit ratio, which is calculated by dividing your aggregate credit card debt by your aggregate credit limits on open credit cards, will likely go up. This can cause your credit scores to go down. However, if you are not carrying debt on other credit cards or the credit limit on the newly closed card was modest enough then the account closure may not result in a change in your debt-to-limit ratio sufficient to result in a score reduction.

If I pay off loans or close credit cards, will it cause their removal from my credit reports?

The credit reporting agencies do not remove accounts once they’ve been closed or paid off. In fact, there is no law requiring the credit reporting agencies to ever remove accounts that are in good standing. At this time, however, the credit reporting agencies choose to remove inactive or closed accounts 10 years after they’ve been closed. Additionally, while closed or paid off accounts are still on your credit reports they are still considered by credit scoring systems.

If I don’t have a long credit history, can I still get a VantageScore® credit score?

One of the differentiating factors of the VantageScore® models is their ability to calculate scores for more consumers, which includes those that are new to the credit market, are infrequent users of credit, or have two or fewer credit accounts.

The VantageScore® models are more likely to provide a score for consumers who are very new to credit and have less than 6 months of history. They also score those who had activity up to two years ago on at least one of the accounts in their file. Many traditional scores limit this review to those with at least 6 months of credit history, and who continue to keep their credit accounts active.

Go to main navigation